In the first half of 2021, Waterloo EDC put a focus on using data to identify cluster strength. The presence of a cluster is shorthand for all sorts of business advantages: access to talent, access to partners/customers, access to research capacity, etc.

There’s a reason you find lots of tech workers in Silicon Valley, lots of movie sets in Georgia, lots of oil production/processing in Texas and tons of tourist attractions in Florida. The reasons can be geographic, due to government policy or simply a fluke of history. The first step is identifying clusters – they aren’t always so obvious – before figuring out what makes them so special.

We began our “Mapped” series with an explainer about location quotient, an important tool that site selectors use to measure the concentration of specific types of skill, talent and businesses in a given region. We followed with a series of blog posts looking at individual clusters across North America:

- Technology

- Advanced Manufacturing

- Business Services

- Life Sciences

- Creative Industries

- Food and Beverage

- Finance and Insurance

Click each link for the full article. You can read a summary of each below:

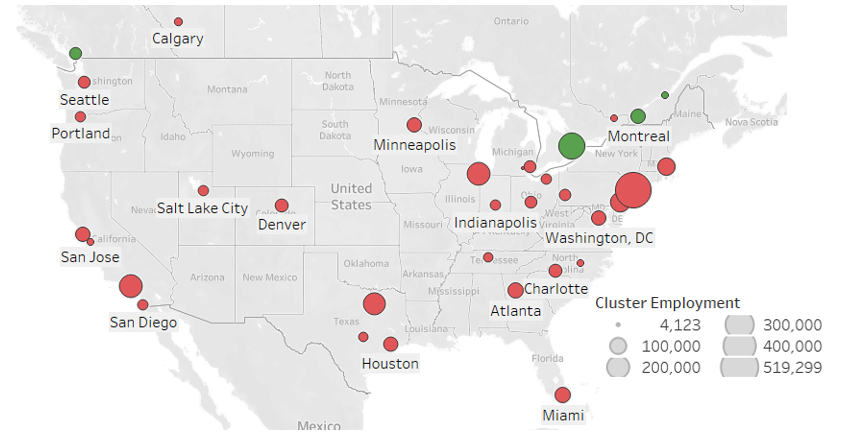

Note: If the circle is green, it’s a “true” cluster. If it’s red, then a cluster effect isn’t evident. The circle size is representative of total cluster employment – the bigger the circle, the more employees. As you can see, a community can have high employment in a particular industry but NOT be a cluster.

Technology

No one is surprised that Silicon Valley is a “true” cluster, same with Seattle and Boston. The Toronto-Waterloo Corridor in Canada – the second largest tech cluster in North America – also isn’t much of a surprise.

But, maybe Washington and New York City weren’t on your radar as tech clusters worth exploring. Same with Ottawa and Calgary in Canada.

Read our full article for location quotient data on the top five large and small tech clusters.

Advanced Manufacturing

A ton of surprises on our advanced manufacturing location quotient map. San Diego instead of Los Angeles? No Pittsburgh, Indianapolis or Columbus?

Detroit is going strong, and Waterloo – right at the centre of Canada’s largest manufacturing corridor – makes the list without issue.

Business Services

Great businesses always need great business support, so if you’re looking for consultants, agencies, legal and accounting support, it’s important to find a top business services cluster.

According to this map that’s… almost everywhere? In this case, concentration is more about degrees – which communities are the strongest clusters?

Life Sciences

The exact opposite of business services – life sciences is pretty sparse as clusters go. Nothing in the United States and just three in Canada.

The absence of Boston, San Francisco and New York left us scratching our heads – these maps are based on government-sourced data crunched by a world-class consulting firm.

Our hypothesis? Defining life sciences isn’t easy, so if medtech falls under tech and pharmaceuticals falls under manufacturing, maybe there just isn’t enough left to form a cluster.

Creative Industries

Like business services, most business would struggle without support from creative industries – designers, videographers, animators, editors and more.

It turns out these professionals are harder to find than accountants, with communities like Los Angeles, Toronto and Vancouver – all home to the film industry – popping up as some of the few large-scale “true” clusters.

Food and Beverage

Food and beverage is its own beast. You need access to food producers, extremely specialized talent and proximity to large consumer markets.

It’s a balance between being large enough to have a built-in market and small enough to have access to rural areas and inexpensive land. As you can see, lots of communities didn’t make the cut.

Finance and Insurance

Finance and insurance also comes with some specialized requirements: low political risk, a respect for the rule of law, a helpful regulatory order and a well-educated workforce. Once again, this turns out to be a very Canadian cocktail.

We’re also surprised to not see New York or Chicago. But, honestly, we’re surprised to simply see so few finance and insurance clusters.

We have everything you need to justify a Canadian expansion.